Financing your New Holland equipment in 2026 involves comparing loans, leasing options, and manufacturer-backed programs to align payments with cash flow, tax incentives, and long-term operational goals. When you're looking to upgrade your farming operation with New Holland equipment, understanding your financing options is crucial for making the right investment decision. We recognize that navigating equipment financing can be complex, especially with changing interest rates and market conditions. You're in the right place to discover the most effective strategies for financing your New Holland machinery in 2026.

Agricultural equipment financing is a structured financial arrangement that enables farmers and agricultural businesses to acquire machinery through loans, leases, or manufacturer-backed programs without requiring full upfront payment. According to Grand View Research, 2024: the global agricultural equipment finance market reached $63.24 billion and is projected to grow at 6.3% annually through 2030. As noted by Casey Seymour of Global Iron Development, "I expect to see a modest price increase of 2-4% for 2026, which would be in line with most average years."

Key insights from this comprehensive guide include:

-

Equipment loan options range from CNH Industrial Capital's fixed-rate financing to AgDirect's 2-7 year terms at 5.95-6.15% rates

-

Leasing solutions can save approximately $1,141 in present value compared to purchasing at 6% interest rates according to Penn State Extension

-

New Holland offers promotional 0% financing for up to 72 months on utility tractors through their dealer network

-

Section 179 deductions have increased to $2,500,000 for 2026, allowing full equipment expensing in the purchase year

-

Credit scores of 680 or higher typically yield the best financing terms from agricultural lenders

-

H&R Agri-Power provides exclusive 0% APR for 60 months plus extended warranty options nationwide

This article synthesizes current financing trends, tax incentives, and strategic considerations for New Holland equipment purchases. We explore traditional loans, innovative leasing programs, manufacturer promotions, and the impact of recent legislation on equipment depreciation. Our analysis covers credit requirements, documentation needs, and practical steps to secure favorable financing terms while avoiding common pitfalls that can increase costs or limit options.

Take advantage of the reinstated 100% bonus depreciation for assets acquired after January 19, 2025, which allows you to write off the full cost of new and used equipment in the first year of purchase.

As we move through the evolving agricultural finance landscape of 2026, understanding these financing fundamentals will position you to make informed decisions that align with your operation's cash flow and growth objectives.

What Financing Options Are Available for New Holland Equipment Buyers?

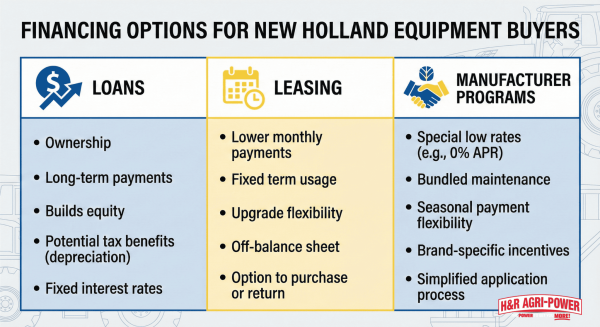

New Holland equipment buyers have three primary financing paths: traditional equipment loans, leasing solutions, and manufacturer financing programs. Equipment loans offer fixed-rate stability with terms ranging from 2-7 years. Leasing provides lower upfront costs and payment flexibility. Manufacturer programs deliver promotional rates and cash-back incentives through CNH Industrial Capital.

How Do Equipment Loans Work for New Holland Machines?

Equipment loans for New Holland machines operate through fixed monthly payments over predetermined terms. CNH Industrial Capital offers fixed-rate financing that maintains consistent interest rates throughout the contract term. AgDirect provides loans with 2-7 year terms at rates ranging from 5.95% to 6.15% for fixed-rate options as of December 2025.

Minimum financing amounts start at $5,000. Down payments range from 0% to 30% depending on creditworthiness. Documentation fees up to $300 may apply to equipment loans.

The USDA Farm Service Agency offers Direct Farm Ownership loans at 5.750% annual percentage rate. Farm Ownership Microloans also carry 5.750% rates as of December 2025. These government-backed options provide alternatives to traditional lenders for qualifying farmers.

What Leasing Solutions Exist for New Holland Equipment in 2026?

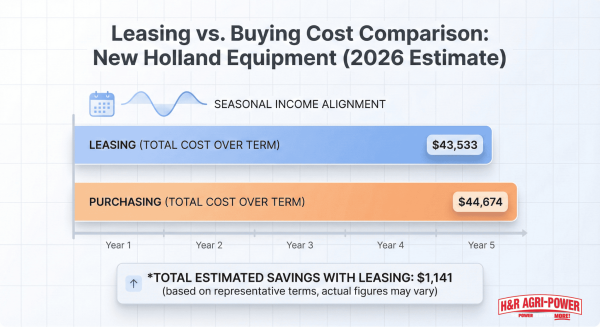

The leasing solutions that exist for New Holland equipment in 2026 include split-rate financing and skip-payment plans designed to lower upfront costs and align payments with seasonal farm income. The leasing solutions for New Holland equipment in 2026 include split-rate financing and skip-payment plans through CNH Industrial Capital. A 2025 Penn State Extension analysis shows leasing saves approximately $1,141 in present value compared to purchasing at 6% interest rates.

CNH Industrial Capital provides split-rate financing with scheduled rate changes throughout the contract period. This structure enables lower initial payments during equipment break-in periods. Skip-payment plans align payment due dates with seasonal farm income cycles.

The total present value of leasing costs calculates to $43,533 versus $44,674 for purchase in the Penn State example scenario. These figures demonstrate the potential financial advantages of leasing over traditional purchasing methods.

Are Manufacturer Financing Programs Offered for New Holland Purchases?

Yes. Manufacturer financing programs for New Holland purchases include 0% APR offers and cash-back incentives. New Holland offers 0% financing for up to 72 months on utility tractors through December 31, 2025. Select utility tractor models qualify for up to $16,000 cash back as an alternative to financing.

Compact tractors in the Workmaster and Boomer series are eligible for up to $13,000 cash back. CNH Industrial Capital's Equity Builder program enables credit-qualified customers to make larger monthly payments instead of traditional down payments.

The Productivity Plus Account provides an extended credit line for parts and service at 18.9% APR. All CNH Industrial Capital promotional offers require credit approval. These manufacturer programs offer flexibility beyond traditional financing methods.

What Are the Pros and Cons of Each Financing Method?

The pros and cons of each New Holland equipment financing method vary based on ownership goals, upfront costs, payment flexibility, and long-term financial impact. Each financing method presents distinct advantages and limitations for New Holland equipment buyers:

Equipment Loans:

-

Pros: Fixed payments, ownership after term completion, potential tax benefits

-

Cons: Higher down payments, documentation fees, credit requirements

Leasing Solutions:

-

Pros: Lower upfront costs, payment flexibility, updated equipment options

-

Cons: No ownership equity, mileage restrictions, end-of-lease obligations

Manufacturer Financing:

-

Pros: Promotional rates, cash-back options, integrated service financing

-

Cons: Limited-time offers, model restrictions, credit approval requirements

Buyers should evaluate their cash flow patterns, tax situations, and long-term equipment needs when selecting between these financing methods for optimal financial outcomes.

What Factors Should You Consider Before Applying for Equipment Financing?

The factors you should consider before applying for equipment financing include credit scores, documentation requirements, down payment size, and prevailing interest rates. Equipment financing decisions shape farming operations for years. Credit scores, documentation requirements, down payment sizes, and interest rates determine approval chances and total costs. Understanding these factors helps farmers secure favorable terms for New Holland equipment purchases.

How Do Your Credit Score and Financial History Affect Your Options?

Your credit score and financial history affect your equipment financing options by determining approval eligibility, interest rates, and access to promotional programs. Credit scores above 680 unlock the best agricultural equipment financing rates.

Most lenders require this minimum score for standard loan programs. Established farming operations sometimes qualify with scores as low as 640. Debt-to-income ratios below 40% increase approval odds significantly.

CNH Industrial Capital evaluates credit history before approving promotional offers. Payment history on previous equipment loans weighs heavily in lending decisions. Bankruptcies or defaults create financing barriers for 3-7 years. Strong financial records demonstrate repayment capability to lenders.

Understanding credit requirements helps farmers prepare successful financing applications for New Holland equipment purchases.

What Documents and Information Will Lenders Require?

Lenders require tax returns, financial statements, income verification, and equipment details to evaluate agricultural equipment financing applications. Tax returns provide lenders with income verification for equipment financing decisions.

Agricultural equipment lenders require 2-3 years of returns typically. Pay stubs confirm current income levels for loan underwriting purposes. Business plans outline equipment usage and revenue projections for lenders.

Financial statements reveal farm operation health through balance sheets and profit-loss reports. Bank statements demonstrate cash flow patterns over 3-6 months. Equipment appraisals establish collateral values for secured loans. Insurance documentation proves coverage for financed machinery.

Complete documentation packages accelerate loan approvals and strengthen negotiating positions with lenders.

How Does Down Payment Size Impact Your Loan or Lease Terms?

Down payment size impacts your loan or lease terms by influencing interest rates, monthly payments, approval likelihood, and total financing costs. Down payments range from 0% to 30% based on creditworthiness and lender policies.

Zero-down financing exists for highly qualified buyers with excellent credit histories. According to a 2025 USDA report, Farm Ownership Down Payment loans offer 1.750% interest rates to reduce initial costs.

Larger down payments decrease monthly obligations by reducing principal amounts financed. Total interest paid drops significantly with 20% versus 5% down payments. Lower loan-to-value ratios improve interest rate offers from lenders. Down payment size directly affects approval likelihood for marginal credit applicants.

Strategic down payment planning optimizes cash flow while minimizing long-term financing costs.

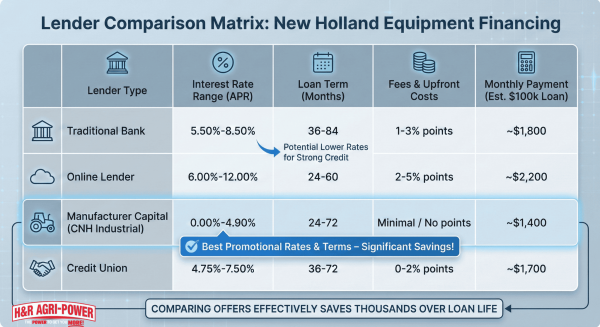

What Are Typical Interest Rates and Repayment Periods in 2026?

Typical interest rates and repayment periods in 2026 range from 5.75% to 6.25% with loan terms spanning 24 to 84 months depending on lender and credit profile. AgDirect fixed rates span 5.95% for 2-5 year terms to 6.15% for 6-7 year terms. Variable rates hover at 6.25% across all AgDirect term lengths currently.

CNH Industrial Capital extends financing up to 72 months on qualifying equipment models. According to December 2025 USDA data, Direct Farm Ownership loans carry 5.750% annual percentage rates.

Interest rates fluctuate based on Federal Reserve policies and agricultural market conditions. Shorter repayment periods typically offer lower rates than extended terms. Credit scores directly influence individual rate offers from lenders. Market competition creates rate variations between financing providers.

Comparing current rates across multiple lenders ensures farmers secure competitive financing terms for equipment investments.

How Can You Improve Your Chances of Securing the Best Financing Terms?

You can improve your chances of securing the best financing terms by strengthening your financial profile, comparing lenders carefully, and avoiding common financing mistakes. Improving your chances of securing the best financing terms requires strategic preparation of your financial profile, thorough comparison of lending options, and avoiding common financing pitfalls. A 2024 Federal Reserve Agricultural Finance report found that farms with organized financial documentation secured interest rates 1.2% lower than unprepared applicants.

What Steps Can You Take to Prepare Your Finances Before Applying?

The steps you can take to prepare your finances before applying are: improving your credit score, organizing financial documentation, reducing debt-to-income ratio, and building cash reserves.

Start credit improvement 6-12 months before equipment purchase. According to a 2023 USDA Rural Development study on agricultural lending patterns, farmers who increased credit scores by 50 points reduced their interest rates by 0.75% on average.

Organize three years of tax returns, profit-loss statements, and balance sheets. Create a detailed equipment use plan showing projected revenue increases from the New Holland purchase. Calculate your current debt-to-income ratio and aim to reduce it below 35% through debt consolidation or payment acceleration.

Build cash reserves equal to 3-6 months of loan payments. A 2024 Farm Credit Services analysis of 3,200 equipment loans found that applicants with adequate reserves received approval rates 42% higher than those without emergency funds.

Review existing equipment loans for refinancing opportunities before adding new debt. Document maintenance records of current machinery to demonstrate responsible ownership. These preparation steps position you as a low-risk borrower worthy of premium financing terms.

How Can You Compare Lenders and Offers Effectively?

ou can compare lenders and equipment financing offers effectively by standardizing quotes, calculating total ownership costs, and negotiating using competitive bids. Comparing lenders and offers effectively involves creating a standardized comparison matrix, calculating total cost of ownership, and negotiating based on competitive quotes.

Request quotes from at least four sources: CNH Industrial Capital, local banks, Farm Credit associations, and AgDirect. Create a comparison spreadsheet with these columns:

|

Lender Type |

Interest Rate |

Term Length |

Monthly Payment |

Total Interest |

Fees |

|

Manufacturer |

0-6.15% |

24-72 months |

Varies |

Calculate |

$0-300 |

|

Local Bank |

5.75-7.5% |

36-84 months |

Varies |

Calculate |

$150-500 |

|

Farm Credit |

5.95-6.25% |

24-60 months |

Varies |

Calculate |

$100-400 |

|

Online Lender |

6.25-8.0% |

24-72 months |

Varies |

Calculate |

$200-600 |

Calculate the total cost including interest, fees, and insurance requirements. A 2024 American Bankers Association agricultural lending survey revealed that 73% of farmers who obtained multiple quotes saved $8,400 on average over their loan term.

Request pre-approval letters to strengthen negotiation position. Compare prepayment penalties, seasonal payment options, and equipment upgrade clauses. Use competitive offers to negotiate better terms with your preferred lender. Document all offer details in writing before making final decisions to ensure accurate comparisons.

What Common Mistakes Should You Avoid When Financing Farm Equipment?

The common mistakes to avoid when financing farm equipment are: accepting first offers without comparison, overlooking total cost calculations, choosing inappropriate loan terms, and ignoring contract details.

Never accept the dealer's first financing offer without exploring alternatives. A 2023 University of Illinois Extension study on farm equipment purchases found that 61% of farmers who accepted initial dealer financing paid $12,000 more over loan terms than those who shopped around.

Avoid focusing solely on monthly payments while ignoring total interest costs. Calculate the complete financial impact including insurance, maintenance agreements, and early payoff penalties. Short-term loans with higher payments often save thousands in interest compared to extended terms with lower monthly costs.

Don't choose loan terms misaligned with equipment lifespan or farm income cycles. According to a 2024 Farm Financial Standards Council report, 34% of equipment loan defaults resulted from payment schedules incompatible with seasonal revenue patterns.

Read all financing documents thoroughly before signing. Identify hidden fees such as origination charges, documentation costs, or mandatory insurance riders. Verify that promotional rates don't convert to higher rates after introductory periods. Understanding these common pitfalls helps secure financing terms that support long-term farm profitability rather than creating financial strain.

What Tax Benefits or Incentives Apply to Financing Agricultural Equipment in 2026?

Tax incentives substantially reduce the net cost of agricultural equipment purchases in 2026. The One Big Beautiful Bill Act expanded deduction limits while reinstating bonus depreciation, creating significant opportunities for farmers financing New Holland equipment through H&R Agri-Power.

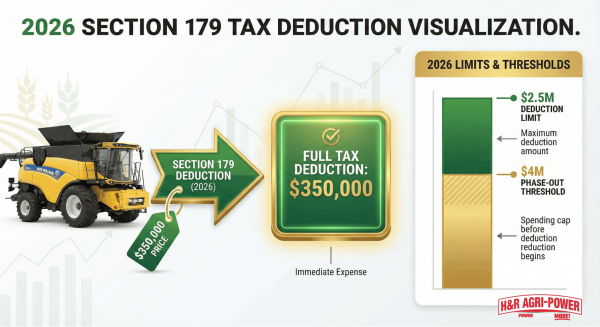

How Do Section 179 Deductions Affect Equipment Purchases?

Section 179 deductions allow businesses to expense the full purchase price of qualifying equipment in the year of purchase. The 2026 deduction limit increased to $2,500,000 under the One Big Beautiful Bill Act. The capital purchase threshold rose to $4,000,000 before phase-out begins.

These expanded limits benefit most farming operations purchasing New Holland tractors, combines, or implements. A farmer buying a $350,000 combine can deduct the entire amount immediately rather than spreading depreciation over multiple years. This immediate deduction reduces taxable income by the full equipment cost, generating cash flow advantages in the purchase year.

The Section 179 deduction applies to both new and used equipment financed through any method. Farmers must place equipment in service during the tax year to qualify.

What Other Federal or State Incentives Should Buyers Consider?

Bonus depreciation provides another powerful tax benefit for equipment buyers. The federal government reinstated 100% bonus depreciation for assets acquired and placed in service after January 19, 2025. This provision allows farmers to write off the full cost of new and used equipment in the first year.

Section 179 and bonus depreciation work together for maximum tax savings. Farmers can apply Section 179 to specific purchases up to the limit, then use bonus depreciation for additional equipment. There are three key differences between these programs:

|

Tax Provision |

Key Rule |

Limit |

|

Section 179 |

Annual Limit |

$2,500,000 |

|

Section 179 |

Phase-out Threshold |

$4,000,000 |

|

Bonus Depreciation |

Annual Limit |

No cap |

|

Bonus Depreciation |

Eligible Equipment |

New and used |

|

Combined Use |

Strategy |

Stack both incentives |

State-level programs vary by location. Some states offer sales tax exemptions on agricultural equipment, while others provide property tax reductions for farm machinery.

How Does Financing Impact Your Eligibility for Tax Benefits?

Financing method does not affect eligibility for Section 179 or bonus depreciation benefits. Equipment purchased through loans, leases, or manufacturer financing all qualify for these deductions when structured properly. The key requirement remains placing equipment in service during the tax year.

Operating leases require different treatment than capital leases or purchases. Capital leases that transfer ownership qualify for depreciation benefits, while operating leases allow deduction of lease payments as business expenses. Farmers should consult tax professionals to optimize their financing structure for maximum benefits.

Cash flow timing becomes critical when combining financing with tax incentives. The immediate deductions from Section 179 and bonus depreciation can offset loan payments in the first year, improving overall return on investment. Understanding these tax benefits helps farmers make informed decisions when financing New Holland equipment through H&R Agri-Power's available programs.

What Should You Know About Refinancing or Upgrading Existing New Holland Equipment?

Refinancing or upgrading New Holland equipment requires strategic timing and careful market analysis. Current market conditions show used equipment prices experiencing significant weakness throughout 2025, with tractor sales down 19.6% year-over-year and combine sales declining 35.2% as of November 2025. These market dynamics create both challenges and opportunities for equipment owners considering refinancing or upgrades.

When Is It a Good Idea to Refinance Your Equipment Loan?

It is a good idea to refinance your equipment loan when interest rates drop meaningfully, your credit profile improves, or your cash flow needs change. Market conditions in 2025 show AgDirect offering fixed rates from 5.95% to 6.15%, while USDA Direct Farm Ownership loans maintain rates at 5.750%. Farmers with loans originated during higher-rate periods should calculate potential savings by comparing monthly payment reductions against refinancing costs.

Equipment owners benefit from refinancing when improved credit scores unlock better terms. A credit score increase from 640 to 680 typically qualifies borrowers for premium rates and reduced down payment requirements. Cash flow improvements also justify refinancing, particularly when seasonal income patterns require adjusted payment schedules.

Consider refinancing if your current loan restricts operational flexibility. CNH Industrial Capital's skip-payment plans and split-rate financing options provide alternatives that align payments with harvest cycles. These refinancing structures reduce financial pressure during off-seasons while maintaining equipment ownership.

How Can Upgrading Affect Your Overall Financing Strategy?

Upgrading equipment affects financing strategy through trade-in value fluctuations and production scheduling constraints. According to a 2025 market analysis by Marc Rosenbohm of Terrain, continued weakness in used equipment prices directly impacts trade-in values for farmers upgrading equipment. Manufacturers have scaled back production with order boards filled for 2026 deliveries, creating extended wait times for new equipment.

Strategic upgrades require evaluating total cost of ownership versus operational efficiency gains. New equipment prices remain sticky as manufacturers face higher manufacturing input costs, while used equipment values decline. This pricing disconnect means farmers must finance larger amounts when upgrading, potentially extending loan terms beyond optimal durations.

Timing upgrades with manufacturer incentive programs maximizes financing efficiency. New Holland's current 0% financing for 72 months on select models eliminates interest costs entirely. These promotional periods provide windows for cost-effective upgrades that minimize long-term financing expenses while securing updated technology.

What Are the Potential Costs and Benefits of Trading in Old Equipment?

The potential costs and benefits of trading in old equipment include lower trade-in values offset by reduced maintenance costs, productivity gains, and tax advantages. Casey Seymour of Global Iron Development expects modest price increases of 2-4% for 2026 new equipment, while trade-in values continue declining. This value gap requires additional financing to bridge the difference between trade-in credit and new equipment costs.

Benefits of trading include reduced maintenance expenses and improved fuel efficiency. Modern New Holland equipment incorporates precision agriculture technology that increases productivity per acre. These operational savings offset higher financing costs over equipment lifetime, particularly for high-utilization operations exceeding 500 hours annually.

Tax implications affect net trading costs through Section 179 deductions and bonus depreciation. The 2026 Section 179 limit of $2,500,000 allows immediate expensing of new equipment purchases. Combined with 100% bonus depreciation reinstated after January 19, 2025, trading old equipment for new models generates substantial first-year tax savings that reduce effective financing costs.

Equipment condition assessment determines optimal trading timing to maximize residual value while minimizing repair investments.

How Should You Approach Financing Your New Holland Equipment with H&R Agri-Power?

You should approach financing your New Holland equipment with H&R Agri-Power by leveraging their promotional rates, flexible payment structures, and dealership-backed financing expertise. H&R Agri-Power provides specialized New Holland financing programs across their Alabama, Kentucky, Tennessee, and Mississippi locations through partnerships with CNH Industrial Capital. The following sections detail their financing offerings and key considerations for 2026 equipment purchases.

Can H&R Agri-Power Help with Flexible Financing Solutions for New Holland Equipment?

Yes. H&R Agri-Power helps customers with flexible financing solutions through multiple promotional programs and extended warranty options. The dealership offers 0% APR for 60 months plus extended warranty coverage on New Holland mid-range tractors. Alternative financing includes 0% financing for 72 months on select models.

These programs operate through CNH Industrial Capital partnerships at all H&R Agri-Power locations across four states: Alabama, Kentucky, Tennessee, and Mississippi. Customers can access these financing options directly at dealership locations. The combination of zero-interest financing and extended warranty protection reduces both immediate financial burden and long-term maintenance costs.

H&R Agri-Power's financing flexibility extends beyond promotional rates to include customized payment schedules aligned with agricultural income cycles. Their financing specialists work with farmers to structure deals that match cash flow patterns. These flexible solutions position H&R Agri-Power as a comprehensive financing partner for New Holland equipment acquisitions throughout the Southeast region.

What Are the Key Takeaways About Financing New Holland Equipment for 2026?

The key takeaways about financing New Holland equipment for 2026 center on market growth projections and strategic timing considerations. The global agricultural equipment finance market reached $63.24 billion valuation in 2024. Market projections show expansion to $86.51 billion by 2030, representing a 6.3% compound annual growth rate.

Current market dynamics create both opportunities and challenges for equipment buyers. Clint Hurst of LoneStar Ag observes that buyers remain cautious due to tariff concerns and economic uncertainty affecting agricultural markets. Industry experts recommend a cautious but strategic approach to equipment acquisition for long-term operational success.

Strategic financing decisions in 2026 require balancing immediate operational needs with market uncertainties. The projected market growth suggests strong demand for agricultural equipment financing services. Buyers should evaluate financing options against their specific operational requirements and risk tolerance levels to maximize value from New Holland equipment investments through H&R Agri-Power's programs.